The past year of 2021, was one for the record books!

I have been in the new home building business for some 40 plus years here in Calgary, and I have never seen a year like 2021!

We had record high lumber prices hitting 400% increases, huge labour shortages, supply chain issues, and an increase in overall building cost that I have never seen before.

Is Good news on the way?

The good news is that lumber is down to what I call somewhat palatable pricing, and the market seems to some degree becoming a bit more normalized; however, don’t let this deceive you into holding off on building your dream home.

I fully expect lumber to go back up in the spring, hopefully not with “stupid prices”!

Labour shortages in Calgary, and COVID restrictions are all expected to plague builders well into 2022, which will in turn drive overall home building cost up!

According to the Canadian Home Builders Association (CHBA) https://www.chba.ca/CHBA , 68% of CHBA members said that their lumber costs went up by more than $20,000 on average, per home built, with 25% of builders reporting that their overall building costs increased by more than $40,000 per home built as a result of surging lumber prices in later part of 2020 into 2021.

The national average of 2021 Q4 construction cost increases for an average 2,374 sq. ft. home by $34,562, being 1.8 times higher than the same survey conducted by CHBA in 2021 Q1.

CHBA Survey respondents 2021 Q4 also said that their construction costs due to rising prices of other materials (other than lumber) have gone up by more than $20,000 per home built, which is double that of the same CHBA survey done Q1.

The good news, is that this was also 17% less than was reported in the CHBA Q2 survey, indicating that overall rising construction cost are somewhat cooling going into 2022. The national average construction cost increases (other than lumber) for an average 2,374 sq. ft. home in 2021 was $25,282, and is not expected to go down, and if anything will most likely increase as we head into 2022.

If combining the lumber cost increase with the other construction material cost increases an average 2,374 sq. ft. home increased in cost close to $60,000 in 2021.

Lumber availability and pricing continue to be a significant issue for builders going forward into 2022, with 73% of CHBA members reporting having trouble accessing lumber products with 58% of CHBA members reporting that structural wood products such as “wood-I-joists, and roof trusses as being VERY difficult to access.

The good news is that these types of structural products look like they will be more available going into 2022, which should help to slow down future home price increases.

Supply Chain Issues causing delays

Supply chain issues have resulted in an average of 7 weeks delay in home completions for most builders across Canada, with 24% of CHBA builders surveyed stating that supply chain issues had resulted in over 9 weeks of construction delays.

Going forward into 2020 expect these delays to persist, especially due to projected labour shortages.

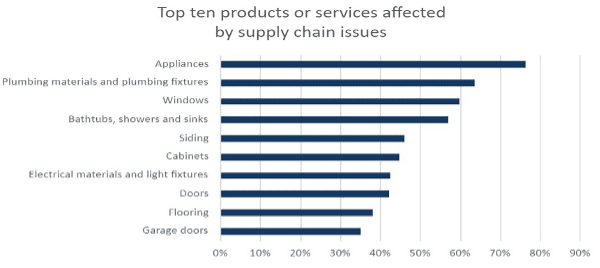

CHBA survey respondents also reported that they had several key challenges due to major supply chain issues, with appliances being the most mentioned product that has been impacted, followed by plumbing materials, plumbing fixtures and windows.

Chart source: CHBA

55% of CHBA survey respondents reported 2020 Q4 that overall market price volatility had resulted in their company delaying pre-sales and/or development, this being 12% higher than the same CHBA survey done in 2021 Q1.

82% of CHBA members reporting that trades, and subcontractor prices have gone up substantially.

With 61% of builders stating that access to trades is much more difficult, and 60% of builders reported that this is causing major construction delays.

On average, CHBA builders reporting that the cost of labour/trades has gone up 19% in 2021, this compared to trade/labour cost prior to the pandemic. With 26% percent of builders reporting that the introduction of COVID stress test measures has impacted home building cost and sales for their company.

Plus the fact that the Federal government support programs like the Canada Recovery Benefit are majorly impacting builders ability to find workers for their job sites, especially in the basic labour force category, this, according to 64% of CHBA’s surveyed builders.

PROJECTED YEAR AHEAD SUMMARY

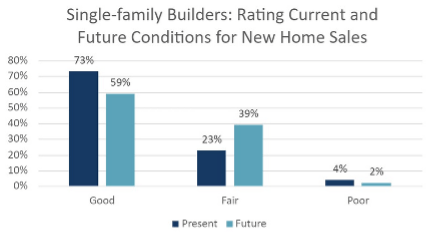

Builders confidence in the Canadian housing market remain fairly high, however overall confidence has dropped a bit since CHBA’ builder survey in 2021 Q2. Mostly due to issues of material and labour price increases, plus supply chain disruptions causing project delays.

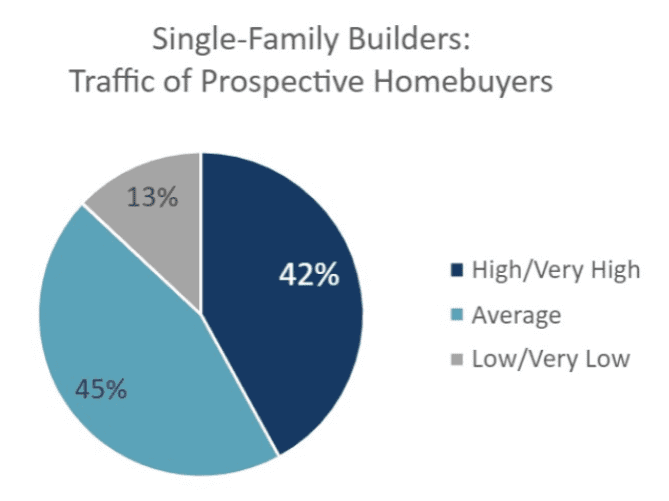

Labour shortages and overall price increases, along with changes to the COVID stress test all add to builder frustration. However, despite all these market challenges most builders are reporting that the current and future conditions look good, and buyer traffic is up, with prospective home buying remaining strong. However, with construction costs for an average 2,374 sq. ft. home being up by $60,000 per home built.

But closings, because of supply and labour challenges, will most like be a bit unpredictable, based on 2021 home turn over delays nationally by an average of 7 weeks.

“Builder Confidence Remains High,

Though Supply Chain and Labour Challenges Dampen Sentiment”

Source: CHBA

The challenges with the supply chain and labour shortages will still being reasonably-high along with the increased demand for single-family homes in Canada, all being factors to consider moving forward into 2022.

Plus the issues of COVID stress test that will very much be further impacting the supply chain and labour availability.

Supply chain issues continue to be a problem, and will be affecting the builder market well into 2022, with 55% percent of builders stating that they are delaying some pre-sales and/or development due to price volatility.

However, the majority of single-family builders rated current and future home building conditions as “Good” with 73% of builders being positive about the market conditions.

With 42% of builders rating traffic of prospective homebuyers as being High to Very High, this is down 21% since the 2021 CHBA Q1 survey.

Chart Source: CHBA

Chart Source: CHBA

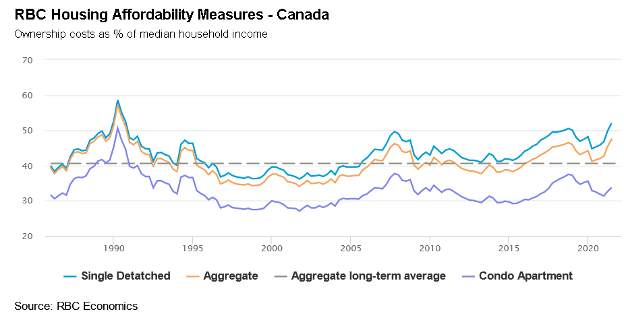

Growth in, housing starts, building permits, home sales and home prices has been slowing towards the end of 2021, however, all market indicators point at a return to more typical levels of home building activity. A recent Royal Bank of Canada projection report indicated that housing starts over the past year have been their strongest since 1977 and the number of new housing units currently under construction is at an all-time high.

The pandemic amplified the housing market

Housing trends have been very similar right across Canada throughout the COVID pandemic.

The past 2020 volatile market conditions have created an intense market demand for homes, with homebuyer demand supercharged and inventories at historical lows in every market right across the country, creating intense competition between buyers, that in turn pushing home prices up.

These conditions have put a lot of pressure on housing affordability. Yet these developments in the past year have somewhat amplified pre-pandemic affordability, with these trends poised to driving some buyers in more expensive regions of Canada such as Toronto or Vancouver toward more affordable regions such as Calgary. Which will most likely add to Calgary’s housing demand.